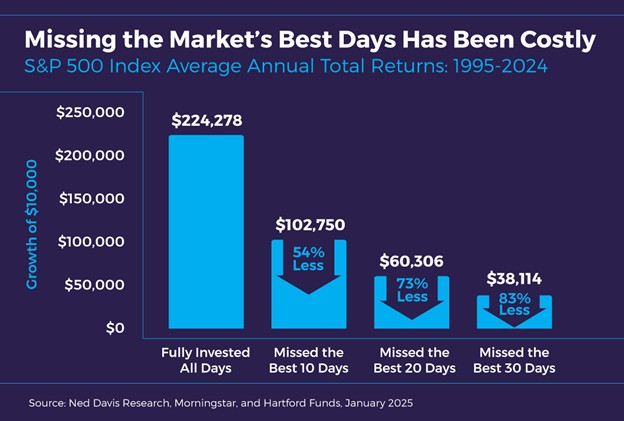

The Four Most Dangerous Words In Investing

“The Four Most Dangerous Words In Investing Are: ‘This Time It’s Different.’” – Sir John Templeton Despite those who say the conventional wisdom that has guided investor actions over the years is no longer valid in 2025, remember the famous quote from legendary investor Sir John Templeton: “The four most dangerous words in investing are: […]

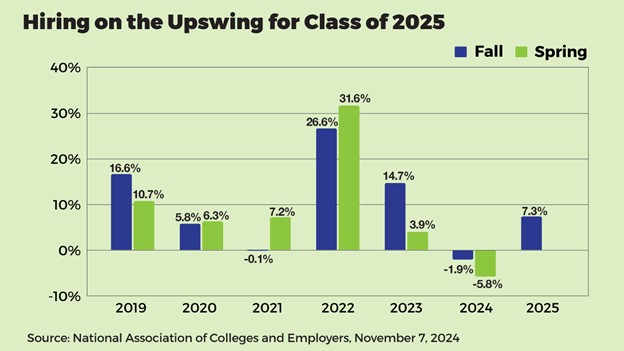

What’s the Job Market Look Like for 2025 Graduates?

It’s graduation season—a time of celebration and new beginnings. For families with college seniors, this time can bring both excitement and uncertainty. While some graduates have jobs lined up, many others still are navigating job searches anxiously. The main reasons for the increase in hiring are employers’ commitment to keeping their talent pipelines full, and […]

Is It Smarter to Buy or Rent a Second Home?

As summer approaches, your thoughts may drift toward escaping your daily routine. Whether your idea of a perfect vacation is sitting on a pristine beach, fishing in a mountain lake, or playing the back nine between pickleball matches, many of our clients have come to us over the years with the same question: Should I […]

From College Acceptances to Affordability: Considerations for Families in the Final Stretch

April is a pivotal time in the college admissions process. After years of preparation, saving, and investing—not to mention the countless hours spent on exam prep, campus visits, and perfecting applications and essays—the finish line is in sight. For families with college-bound students—whether this year, in the near future, or further down the road—the financial […]

Spring Into Financial Wellness: Actionable Steps for Financial Literacy Month

April isn’t just about filing taxes—it’s also Financial Literacy Month, a perfect opportunity to reflect on your financial habits, expand your knowledge, and take meaningful steps toward improving your financial well-being. Whether building your first budget, preparing for retirement, or navigating the complexities of paying for college, financial literacy is the foundation for making confident, […]

10 Things You Can Do Now to Help Simplify Your Estate for Your Heirs:

One of the greatest gifts you can give your loved ones is a thoughtful estate strategy that outlines your wishes after you are gone. Discussing estate details with your team of professionals is another way to help manage your legacy and final wishes. As financial professionals, we often act as the “quarterback” of our client’s […]

The Evolving Role of Women in Family Finances

March is Women’s History Month, and according to a recent survey, 49% of women consider themselves to be the chief financial officer of their households, up from 41% in 2021.1 Those numbers are even more impressive when you consider that until 1974, a married woman often needed her husband’s permission to open a bank account, […]

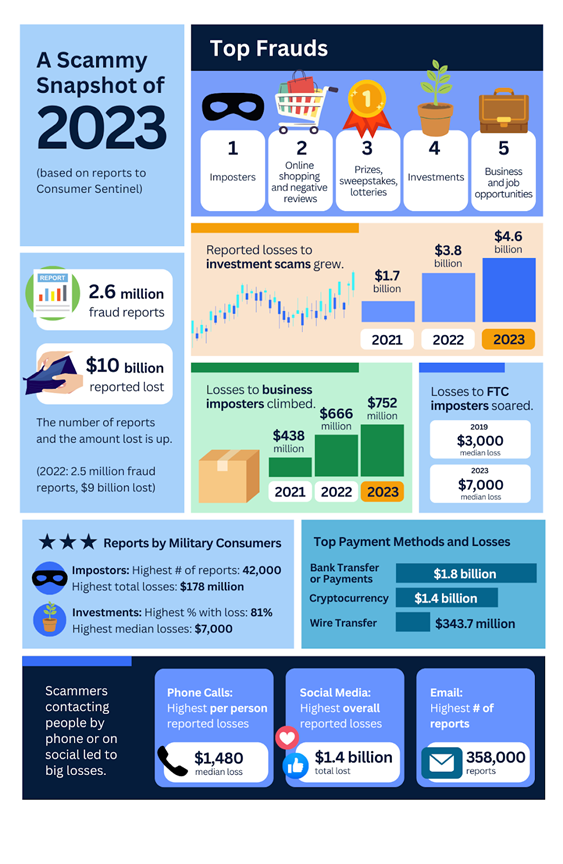

Tax season brings: new wave of identity theft risks

Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of discovering that a criminal beat you to filing your taxes—potentially reaping your refund or creating serious headaches with the Internal Revenue Service (IRS). Unfortunately, this […]

10 Facts You May Not Know About Social Security

Social Security is often misunderstood or underestimated in retirement strategy. However, as financial professionals, we’ve seen how it can play a crucial role in our clients’ overall financial strategy, regardless of their income level or net worth. This program extends beyond basic retirement benefits, offering vital programs and strategic opportunities that can influence your financial […]

Innovative New Year’s Resolutions: Financial and Personal Growth Strategies for 2025

Looks like New Year’s resolutions are still going strong in 2024! A recent Pew survey found that about a third of Americans kicked off the year with at least one resolution, and many people actually went for multiple goals. It’s especially popular with the younger crowd. The good news? Most folks are sticking to their […]