As you approach retirement, a critical aspect of your retirement strategy can catch even the most financially savvy individuals off guard: healthcare costs. For decades, you may have enjoyed employer-sponsored health insurance. As retirement looms, you’re about to enter unfamiliar territory and a healthcare landscape vastly different from what you’ve known.

Employer Insurance Disappears

Many successful professionals are surprised by the complexities and costs of healthcare in retirement. The ease of having your employer help with insurance decisions and subsidize a significant portion of your premiums ends for most when they retire. In retirement, you will be responsible for managing your healthcare options, which can involve evaluating a variety of plans and understanding potential changes in out-of-pocket costs.

The True Cost of Healthcare in Retirement

According to Fidelity’s 2024 Retiree Health Care Cost Estimate, the average 65-year-old individual needs about $165,000 in after-tax savings to cover health care expenses in retirement. This figure is up nearly 5% from 2023 and doesn’t include potential extended care costs.

Factors Driving Costs

There are many drivers behind the rising cost of healthcare for retirees, including:1,2

- Healthcare Inflation: Medical costs consistently outpace general inflation.

- Longevity: As we live longer, healthcare expenses accumulate over more years.

- Advanced Treatments: Cutting-edge medical technologies and procedures often have higher price tags.

- Increased Demand: The aging Baby Boomer population may strain healthcare resources.

Healthcare inflation continues to outpace general inflation, and with individuals living longer, the extra costs might add up over the years. This increase in cost is primarily due to greater demand driven by longevity and advances in treatment and technology. Procedures like joint replacement and cataract surgery, which were once rare, are now considered standard maintenance. Still, they carry higher costs as they impact greater numbers of Baby Boomers who want to stay active in their later years.2

These cost increases are particularly challenging for women, who face higher lifetime care costs due to a life expectancy that is longer than men.

According to a recent study, 80% of respondents are concerned about covering the cost of healthcare in retirement.Even factoring in Medicare coverage, experts estimate that by age 65, healthcare expenditures will likely amount to 15% of your overall spending, a figure that may nearly double by 2040.This figure will vary based on when and where you retire, how healthy you are, and how long you live.2

The Healthcare Landscape for Individuals Retiring Before Age 65

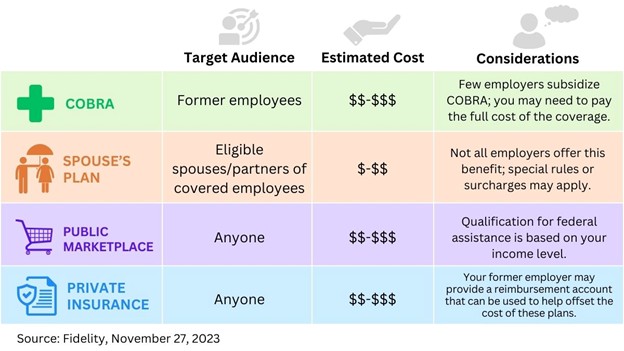

You can start to draw Social Security benefits at 62, three years before Medicare eligibility begins. This gap can be a source of emotional and financial stress. You may want to consider bridging this period with alternative coverage options, which can be costly and complex. If you are retiring before age 65 and don’t have access to retiree health care coverage from your employer, there are four primary options for obtaining coverage.1,3

- COBRA coverage: The Consolidated Omnibus Budget Reconciliation Act of 1985, or COBRA, allows you to continue your current health care coverage for a certain amount of time, but you may be required to pay the full cost of your health coverage, including the amount your employer had subsidized, plus an additional 2% charge.3

- Spouse’s plan: If your spouse or domestic partner is employed and has health coverage, you may be able to get coverage on their employer’s plan.3

- Public marketplace: The Affordable Care Act established the public market and provides plan options available to anyone who is not yet eligible for Medicare. Costs for these plans can vary widely.3

- Private insurance: To obtain coverage, you can also look to your local health insurance agent, trade or professional associations, and other so-called “private exchanges” that offer plans from multiple carriers. You may have more plan options available through these outlets than the public marketplace.3

Navigating Medicare Starting at Age 65

Medicare should be an important part of your retirement healthcare strategy. Most workers pay into the program their entire working lives. Just like Social Security, even if you have sufficient means, they will likely be the foundation of your needs in retirement.

As financial professionals, we can help you with many of your retirement needs, but to be clear, we are not Medicare experts. We will provide a brief overview here, but we have more detailed information we can send you, and we know a variety of professionals we will gladly put you in touch with.

There are many common misconceptions about Medicare, especially in terms of comprehensive coverage. Medicare has significant gaps, limits, and increasingly higher premiums and copays. High-income retirees face additional Medicare premiums, known as Income-Related Monthly Adjustment Amounts (IRMAA).1 Supplemental insurance can help fill the void and cover additional items like dental, hearing, and vision care.2

Understanding Your Medicare Options4

Four parts of Medicare (A, B, C, and D) were created to match your medical coverage needs and budget.

- Parts A (hospital insurance)

- Part A helps pay for inpatient care at:

- Hospitals

- Skilled nursing facilities

- Hospice

- It also covers some outpatient home health care.

- Part A is free if you worked and paid Medicare taxes for at least 10 years. You may also be eligible because of your current or former spouse’s work.

- Part B (medical insurance)

- Part B helps cover the following:

- Services from doctors and other healthcare providers

- Outpatient care

- Home health care

- Durable medical equipment

- Some preventive services

- Most people pay a monthly premium for Part B. The exact premium depends on your income level.

- Part C (Medicare Advantage)

- Part C is known as Medicare Advantage. Private companies run Medicare Part C. The federal government approves each plan. Costs and coverage types vary by provider. It’s an alternative to Parts A and B that bundles several coverage types, including Parts A, B, and usually D. It may also include:

- Vision

- Hearing

- Dental

- You must sign up for Part A or B before enrolling in a Medicare Advantage plan.

- Part D (prescription drug coverage)

- Part D helps cover prescription drug costs. Private companies run Medicare Part D.

- You must sign up for Part A or B before enrolling in Part D.

Medigap Policies5

Medicare Supplement Insurance (Medigap) is extra insurance from a private health insurance company to help you pay for out-of-pocket costs in Original Medicare (Parts A and B). Generally, you must have Original Medicare (Part A) to buy a Medigap policy.

Medigap policies help cover the following:

- Copayments

- Coinsurance

- Deductibles

Importantly for high-net-worth individuals, some Medigap policies cover services that Original Medicare doesn’t, like emergency medical care when traveling outside the U.S.

Medigap plans generally don’t cover:

- Extended care (like a nursing home)

- Vision or dental care

- Hearing aids

- Eyeglasses

- Private-duty nursing

Medigap premiums vary widely depending on the insurance company, the plan, and where you live. Each company decides how to set the price for its policy.

Unique Healthcare Considerations for High-Net-Worth Individuals

High-net-worth individuals have specific challenges and opportunities when managing their healthcare costs and insurance options. Their unique needs, along with their financial standing, lifestyle, and desire for privacy, often require a tailored approach.

- Private Insurance

High-net-worth health insurance policies often come with unique features. These private plans can target particular needs and accommodate elements like international coverage, access to top medical specialists, and faster medical services. This is above and beyond what standard health insurance policies emphasize.6

- Concierge Medicine

Concierge medicine, known as retainer medicine, presents an alternative for high-net-worth individuals seeking personalized healthcare. With concierge services, individuals pay an annual fee to a chosen physician or medical practice. Those fees can be as high as $20,000 per year. In return, they receive expedited appointments, longer consultation times, and a more direct line of communication with their healthcare provider. This approach ensures that medical care is prompt and highly individualized.6

- Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP) with your employer, contributing to an HSA during your working years may allow you to accumulate tax-advantaged funds for certain medical expenses in retirement. HSAs offer flexibility and control over healthcare spending. These accounts have tax-advantaged features for contributions, growth, and withdrawals used to pay for qualified medical expenses, which can make them a popular choice for some. If you have one of these accounts and are still working, remember that an HSA doesn’t have a “use it or lose it” rule, so you don’t have to spend the balance by the end of the year. 6

Here are a couple of things to consider if an HSA sounds interesting. If you spend your HSA funds on non-qualified expenses before age 65, ordinary income taxes may apply, and it may result in a 20% penalty. But, after age 65, you may be required to pay ordinary income tax if the funds are used for non-qualified expenses. Also, remember that contributions are exempt from federal income tax but, in some cases, are not exempt from state tax.

Extended Care Needs

Not every retiree will require extended care services in their lifetime, but many will. According to the Administration for Community Living, a 65-year-old has a 70% chance of needing extended care.7

Paying for extended care often involves a combination of funding sources. Medicare does not typically cover these services, so many people pay for the costs out of pocket. This can be daunting for even well-off individuals. According to Genworth, the estimated median cost of extended care in 2024 is $5,511 per month for assisted living and $10,025 per month for a private room in a nursing home.7

You may want to consider other options to help cover some of these costs, but those solutions come at a price. Regardless of how you intend to pay for possible extended care needs in retirement, it should be factored into your overall retirement strategy.

Individuals concerned about potential extended care costs and estate strategies may want to explore the pros and cons of setting up an irrevocable trust. Irrevocable trusts cannot be modified or amended with the permission of the grantor’s beneficiary, so they can offer certain benefits when creating an estate strategy, depending on your specific situation.

It’s important to note that the rules surrounding these strategies are complex and can vary based on individual circumstances and state laws. Using a trust involves a complex set of tax rules and regulations, so it’s crucial to consult with qualified legal and financial professionals who can provide personalized guidance based on your specific needs and goals.8

Estate Considerations for Healthcare

There are several legal documents that all people should have in place before they have a potential healthcare crisis as they get older. These documents are the building blocks of an estate strategy.

- A medical power of attorney, often referred to as an “advanced medical directive,” “durable power of attorney for health care,” or “health care proxy,” is a specialized legal document that provides someone you choose with the legal capacity to make crucial medical choices in certain circumstances or execute them on your behalf only if you are unable to do so. This legal instrument proves highly beneficial if you ever encounter a situation where you cannot express yourself or rationally evaluate health-related concerns.9

- A living will is a written, legal document that spells out medical treatments you would and would not want to be used to keep you alive, as well as your preferences for other medical decisions, such as pain management or organ donation. Your living will should address several possible end-of-life care scenarios.10

Beyond Insurance

There are a number of healthcare considerations in retirement that extend beyond insurance and Medicare. Here are just a few:

- Holistic Health Management

Holistic health management is a medical approach that focuses on treating and preventing disease by addressing many aspects of a person’s life, including mental, physical, spiritual, and social health.

While conventional medicine often focuses primarily on the physical symptoms of disease, holistic health also focuses on how other aspects of a person’s life contribute to their health.

Features of holistic health include education, self-help, and advocacy. Lifestyle and behavioral changes are also essential, focusing on elements that promote better health—nutrition, movement, sleep, stress management, and relationship support.11 These wellness programs and preventative care strategies can be attractive to retirees.

- Medical Tourism

Medical tourism involves people seeking more affordable, sometimes higher-quality care outside their home country for a wide range of medical procedures, from elective surgeries to advanced care for complex medical conditions. It’s a multibillion-dollar market that continues to grow with globalization.

Medical tourism reasons vary but often include pursuing more affordable treatment options, accessing specialized medical expertise unavailable locally, and combining medical procedures with a luxury travel experience. Some individuals opt for health travel because specific treatments are not recommended locally, may be experimental, or the patient desires anonymity that can be found in a foreign country.

There are risks to pursuing care outside the traditional and highly regulated U.S. system. Differences in healthcare standards across countries may lead to discrepancies in the quality of care and patient safety. Thorough research and due diligence before choosing a health provider abroad are essential.12

- Leveraging Technology for Health Monitoring and Early Intervention

Some people are taking advantage of technological advancements to increase healthcare outcomes. Digital health is a rapidly growing field that offers exciting opportunities for innovation and improvement in healthcare delivery. The goal of digital health is to make healthcare more efficient, accessible, and effective by leveraging the power of digital technology to collect, analyze, store, and share health data. Electronic Health Records (EHRs), telemedicine, mobile health apps, wearable devices, the internet of medical things, and cutting-edge digital technology constitute digital health. The digital health market has been proliferating in recent years and is expected to continue its growth trajectory in the near future.13

Navigating Healthcare in Retirement: A Collaborative Approach

As we’ve explored, healthcare costs in retirement present a complex landscape, especially for high-net-worth individuals. Transitioning from employer-sponsored coverage to navigating Medicare, private insurance, and other healthcare options can be emotionally and financially challenging. However, with preparation and guidance, you can begin to navigate this crucial aspect of your retirement journey.

Our Role as Financial Professionals

As financial professionals, we are committed to helping you prepare for the many challenges you may face in retirement. We can help by creating financial strategies that consider healthcare costs as part of your overall retirement picture. We can assist you with:

- Integrating healthcare cost projections into your retirement plan

- Evaluating the impact of healthcare costs on your estate strategy

- Reviewing various healthcare choices and their financial implications

Next Steps

As you approach retirement, we encourage you to:

- Schedule a meeting with us to review your overall retirement strategy, including healthcare cost considerations

- Consider a consultation with a Medicare professional to dive deep into your specific coverage needs

By using your resources, you can create a robust retirement strategy that’s designed to address all of your potential needs. Preparing for healthcare in retirement is an ongoing process. We’re here to support you every step of the way. Contact us today to start this important conversation about your retirement healthcare strategy. Your future well-being is our priority, and we look forward to helping you navigate this critical aspect of your retirement.

Sources

1. Fidelity, August 12, 2024

https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

2. RBC Wealth Management, August 2023

https://www.rbcwealthmanagement.com/assets/wp-content/uploads/documents/insights/taking-control-of-health-care-in-retirement.pdf

3. Fidelity, November 27, 2023

https://www.fidelity.com/viewpoints/retirement/transition-to-medicare

4. Social Security Administration, September 20, 2024

https://www.ssa.gov/medicare/plan/medicare-parts

5. Medicare.gov, September 20, 2024

https://www.medicare.gov/health-drug-plans/medigap/basics

6. Smart Assets, August 31, 2023

https://smartasset.com/insurance/health-insurance-for-high-net-worth-individuals

7. SeniorLiving.org, June 25, 2024

https://www.seniorliving.org/care/cost/calculator/

8. Trust & Wills, September 20, 2024

https://trustandwill.com/learn/protect-assets-from-nursing-home-costs

9. SingleCare.com, November 9, 2023

https://www.singlecare.com/blog/medical-power-of-attorney/

10. Mayo Clinic, September 20, 2024

https://www.mayoclinic.org/healthy-lifestyle/consumer-health/in-depth/living-wills/art-20046303

11. Health.com, May 30, 2024

https://www.health.com/holistic-health-8652522

12. Forbes, November 29, 2024

https://www.forbes.com/sites/nicoleroberts/2023/11/29/what-is-medical-tourism-traveling-for-healthcare-explained/

13. National Library of Medicine, April 11, 2023

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC10089382/

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.