“The Four Most Dangerous Words In Investing Are: ‘This Time It’s Different.’”

– Sir John Templeton

Despite those who say the conventional wisdom that has guided investor actions over the years is no longer valid in 2025, remember the famous quote from legendary investor Sir John Templeton: “The four most dangerous words in investing are: ‘This time it’s different.'”

While the underlying cause of market volatility may differ from what we experienced during other periods of volatility, the reality is that a market pullback is not unusual or unexpected. In fact, since the early 1980s, there has been a greater than 5 percent drawdown in the S&P 500 Index every year but two (1995 and 2017)!1

Consider this: from 1980 to 2020, the S&P 500 experienced average annual drops of approximately 13.7 percent at some point during the year, yet still finished positive in 75 percent of those years. Corrections are not anomalies — they are consistent and natural. Even during more severe events like the 2020 COVID crash, the market dropped over 30 percent, only to recover within six months and reach new highs.2

This data points to the fact that stock market pullbacks are a normal part of the market cycle and should be anticipated. So, while pullbacks can be unsettling in the short term, history suggests that staying invested and maintaining a long-term perspective can be beneficial. Instead of viewing pullbacks as a cause for fear, they should be seen as a normal and even necessary part of the market’s health and growth.3

It’s worth noting that some of the best investment days historically come on the heels of the worst ones. Using the S&P 500 as a proxy for the stock market, the charts below show that, over time, holding stocks has rewarded patient investors.4

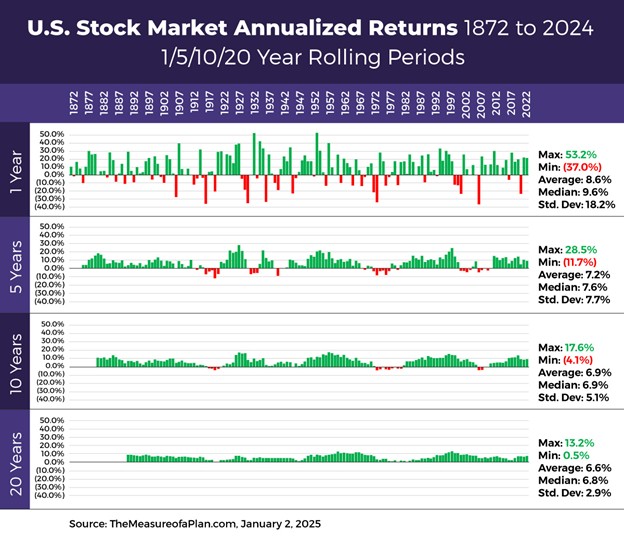

During one-year periods between 1892 and 2024, market returns have fluctuated greatly from down 37.0 percent to up 53.2 percent. However, holding stocks for five and 10 years resulted in fewer down periods. Historically, over 20-year timeframes showed no negative periods, ranging from +0.5 percent to +13.2 percent annual returns.5

This shows the potential benefits of staying invested in the market, especially for those with longer time horizons.

Note: the real total return with dividends reinvested and adjusted for inflation. An investor’s rate of return might not precisely match broader indexes such as the S&P 500 due to factors like when and what they invest in.5 The S&P 500 index was introduced in March 1957, when it was expanded from 90 companies to 500 and renamed the S&P 500 Stock Composite Index.

But, What If We Are In a Bear Market?

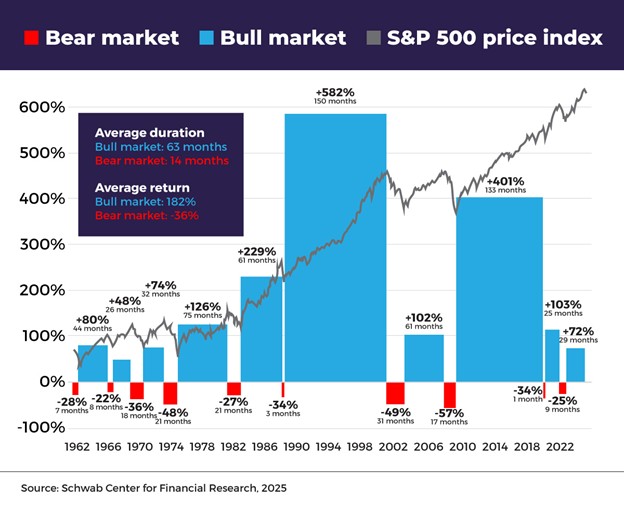

It can be unnerving to consider entering a bear market. However, the chart below shows the average duration and returns during bull and bear markets. It illustrates that bear markets have been much shorter historically than bull markets.ne you know would like to discuss any aspects of this blog, feel free to reach out to our team anytime.

The Downside of Missing the Market’s Best Days

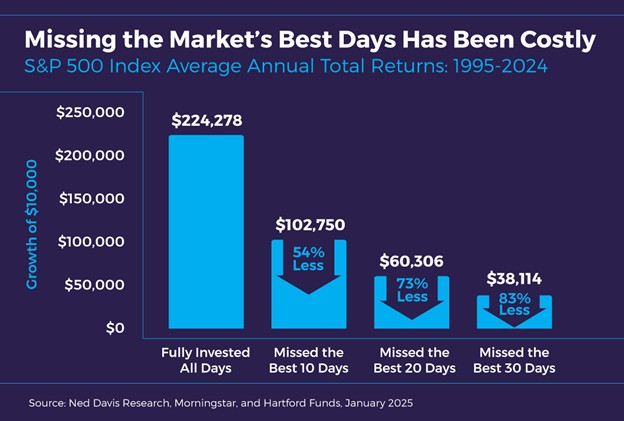

It is natural to wonder if you should change your portfolio during such times. The problem? Recoveries have historically happened quickly after market downturns. Missing just a few of the best days in the market can impact long-term returns.6

Timing the market is challenging because investors never know when the great days are coming. Seventy-eight percent of the stock market’s best days happened during bear markets or the first two months of a bull market.6

If you sat out only the 10 best days in the market over the past 30 years, your returns would have been cut in half. If you missed the best 30 days, your returns would have been reduced by 83 percent, erasing almost all your potential gains.7

Past performance does not guarantee future results. For illustrative purposes only. Data Sources: Ned Davis Research, Morningstar, and Hartford Funds, January 2025.

As the chart illustrates, timing the markets rarely works. It is difficult to avoid the downside while gaining from the upside. Think of investors who sold during the financial crisis of 2008-09, only to miss one of the strongest bull markets in history. Buy-and-hold is more than a theory; it’s a valid approach for investors with growth aspirations and longer time horizons.

Dollar-Cost-Averaging

If you are looking to put some capital to work in the markets but do not want to rush in all at once, you can use the method known as dollar-cost averaging.

Dollar-cost averaging is the time-tested practice of systematically investing equal amounts of money in various markets at regular intervals, regardless of the price. Remember that dollar-cost averaging does not protect against a loss in a declining market or guarantee a profit in a rising market. Investors should evaluate their financial ability to continue purchasing through declining and rising prices. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.

The alternative to dollar-cost averaging is lump-sum investing. This is where you put all the money you want to invest in the market at once. This approach can be more beneficial than dollar-cost averaging because it exposes you to the market sooner.6

A Northwestern Mutual study found that lump-sum investing generated better cumulative returns at the end of 10 years than dollar-cost averaging, almost 75 percent of the time.6 Of course, you should consult with a financial professional to determine which investing approach makes sense for you.

Diversification to Spread Your Risk

Diversification is an approach to help manage, but not eliminate, investment risk in the event that security prices decline.

By its nature, diversification is designed to align an investor’s goals, time horizon, and risk tolerance. For example, a portfolio concentrated in a single investment may deliver higher returns, but it also might carry higher risks. A diversified portfolio is designed to help manage risk during market cycles.8

Asset allocation is an approach to help manage investment risk but it does not guarantee against investment loss. By investing in multiple asset classes, which have varying drivers of returns, your portfolio might be positioned to weather different market and economic environments.

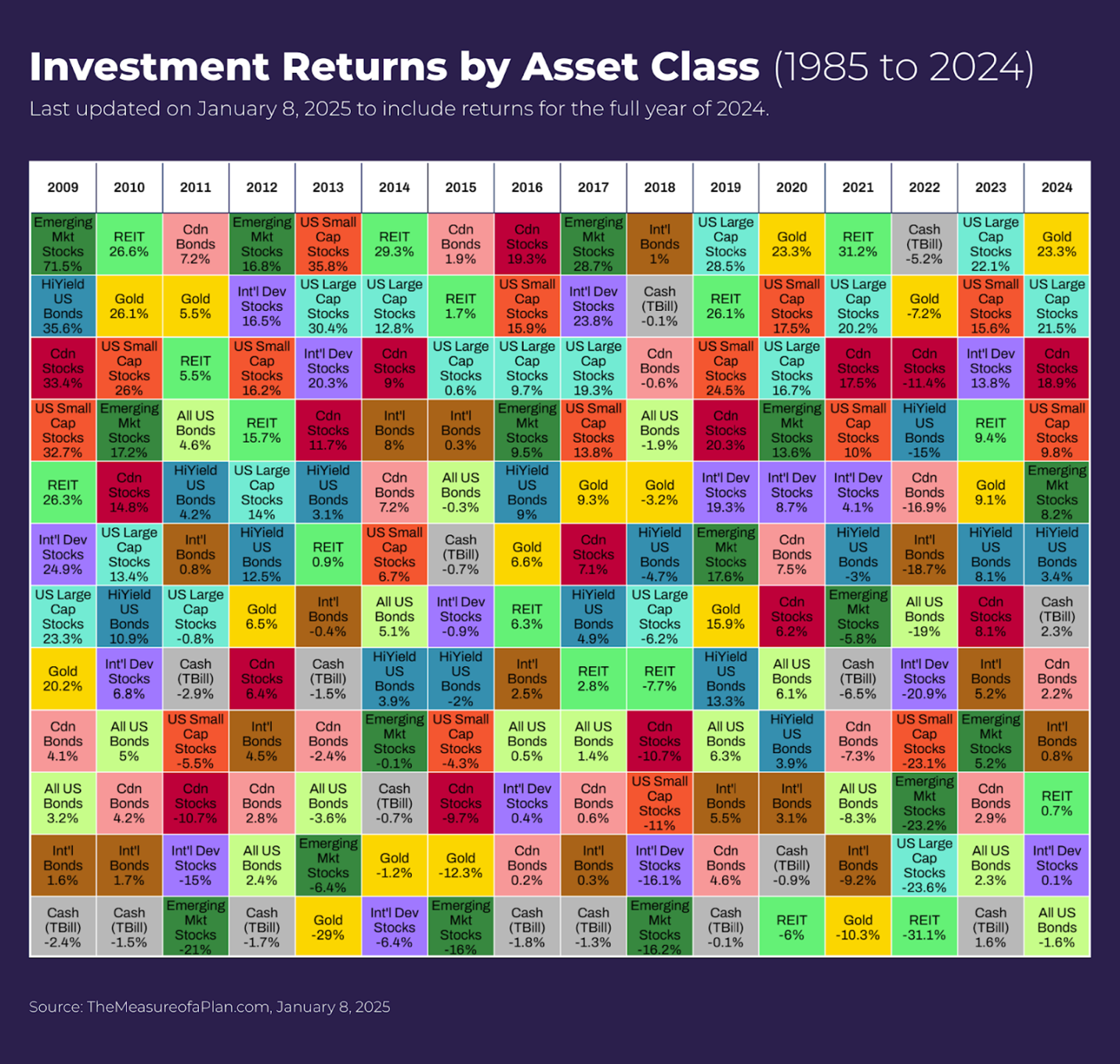

Going back to 1985, nine different asset classes have performed best in a year. On the flipside, six different asset classes have wound up as the worst-performing. If you look at the chart, there are years when the best asset class in a given year falls to the bottom the following year, and vice versa.9

This analysis covers historical investment returns by asset class from 1985 to 2024 for a wide range of investments, including stocks/bonds in the U.S., Canada, and beyond, gold, and real estate.

So What Should You Do?

Regardless of what the market is doing today, here’s what history has shown about investing:

- Stick to Your Investment Strategy — A well-diversified portfolio is designed to weather market fluctuations.

- Manage Withdrawals — Instead of withdrawing money in a market downturn, you may want to manage your cash flow so your portfolio can continue to work for you.

- Stay Focused on the Long Game — The market tends to reward disciplined investors who don’t let headlines dictate their financial decisions.

We Are Here to Help

If you believe it’s time to either start working with a financial professional or just get a second opinion on your current approach, please call or email us to set up a time to meet. Remember, this time may be different, but the result has always been the same. We’re here to help.

Historical data indicates that long-term strategies that focus on U.S. stocks have been associated with investment opportunities. Remember, past performance does not guarantee future results. Focusing on long-term growth goals, taking advantage of compounding, and avoiding emotional impulses may allow investors to build wealth over time.

The Standard & Poor’s 500, an unmanaged index that is considered representative of the overall U.S. stock market, has gained 10.5 percent annually since its inception in 1957. This covers almost a 70-year period of wars, recessions, political events, “irrational exuberance,” and boom/bust cycles. Investors who maintained discipline have been rewarded over time.

Sources:

- Business Insider.com, January 2, 2025

https://www.businessinsider.com/personal-finance/investing/average-stock-market-return - BairdWealth.com, March 14, 2024. The S&P 500 Composite Index represents the stock market, which is an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

https://www.bairdwealth.com/insights/market-insights/baird-market-strategy/2024/03/all-that-matters-elections-and-your-money/ - Nasdaq, March 8, 2025

https://www.nasdaq.com/articles/how-stock-market-performed-these-12-presidents-first-year-office - BusinessInsider.com, January 2, 2025

https://www.businessinsider.com/personal-finance/investing/average-stock-market-return - The Measure Of A Plan, January 2, 2025

https://themeasureofaplan.com/us-stock-market-returns-1870s-to-present/ - Business Insider, March 7, 2025

https://www.businessinsider.com/personal-finance/investing/dollar-cost-averaging - Investopedia, May 23, 2024

https://www.investopedia.com/terms/d/dollarcostaveraging.asp - Forbes, February 19, 2024

https://www.forbes.com/uk/advisor/investing/what-is-diversification/ - The Measure Of A Plan, January 8, 2025

https://themeasureofaplan.com/investment-returns-by-asset-class/ - MoneyWise.com, February 11, 2025

https://moneywise.com/retirement/retirement/why-people-who-work-with-a-financial-advisor-retire-richer

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.